Sales Tax Exemption

- Utah law requires every PTA to pay sales tax on purchases under $1,000. That sales tax is refunded upon request.

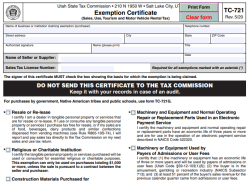

- For purchases over $1000, the tax exempt number 12510060-002-STC should be used.

- A vendor may request an Exemption Certificate from a PTA to verify the tax exempt number. This certificate can be obtained from the Utah PTA office through kids@utahpta.org.

- Utah PTA has established, within the guidelines of the State of Utah, a procedure whereby PTA units may request a refund of the sales tax paid.

- All PTA sales tax refund requests must be made through the Utah PTA.

Fundraising and Sales Tax

Local and council PTAs are not required to collect or pay sales tax on fundraising events where the items sold are not available to the general public. When a PTA does a fundraising event, if the money is collected by the vendor and not by the PTA, sales tax must be collected by the vendor.

Book Fair Sales and Sales Tax

We must collect sales tax on books sold at book fairs, since we are selling a third party's product for them. In 2017 the Utah State Tax Commission changed the rules. Book fair companies are now classified as "3rd party sales" companies. This means they bring books, etc. to your school for the sale. Then they pick up the leftover books, etc. to resell at the next book fair. You must charge sales tax to all customers.

If the school wants to use their tax exempt number to purchase books, please see that the book fair company knows the amount and gets the tax exempt number for their records.

When accounting is finished at the end of the book fair, you will send them all the sales taxes plus what sales you owe them. The book fair company will be responsible to pay Utah State Tax Commission the appropriate taxes.

Sales Tax Refund Requests

Due August 1

Requests for sales tax refunds can be submitted once a year for period July 1 through June 30. Sales tax for up to 3 years back from the submitted date can be requested if a previous request for that period hasn't been made. Each fiscal year must be requested separately. Check to make sure that the appropriate period is covered by the specified deadline. Also, do not include any items outside of the period to be covered.

Requests for sales tax refunds can be submitted once a year for period July 1 through June 30. Sales tax for up to 3 years back from the submitted date can be requested if a previous request for that period hasn't been made. Each fiscal year must be requested separately. Check to make sure that the appropriate period is covered by the specified deadline. Also, do not include any items outside of the period to be covered. - To receive a refund from the State of Utah, a PTA making a refund request must be a PTA in good standing. This means that it must have an EIN, current bylaws, remitted all membership dues to Utah PTA and National PTA, and submitted all beginning of year and end of year paperwork. Check your local bylaws to be sure that they are current.

- Requests must include a list of the checks paid or prepaid spending card transactions in order by date with purpose and sales tax amount shown. You may handwrite your list using the form attached below or may keep your list in Quickbooks, Quicken, Microsoft Excel, Google Sheets or other financial program. It is best if your list has your PTA name on it somewhere. Please save the list as a PDF or take a picture of the list and submit an image file.

- Once the form is submitted, it takes approximately three months for a check to be received back from the Utah State Tax Commission via Utah PTA.

- There is no minimum amount for which a refund request may be made. Remember that $2.00 is subtracted from each refund for processing costs if the refund is over $20.00. Under $20.00, there is no fee. Checks will be mailed directly to your school. Please deposit refunds promptly.

- Completing a Sales Tax Refund Request should not be viewed as an optional activity. These funds can and should be requested so that they can be used to further the work of your PTA.

Instructions for Submitting Request

- Log In to UtahPTA.org.

- Click on the User icon in the top right corner and click My Account.

- Click the $ Tax button next to your unit (see notes below for help with this step). Only the treasurer or the president may submit a sales tax refund request.

- Click the green +Submit Request button on the right side.

- Follow the instructions on the form and complete all the fields, then click Save.

Important Notes

- If your unit does not appear in your PTA Units list, click the Add Unit button to link your PTA unit.

- If your unit appears in your PTA Unit list but there is no $ Tax button, click Edit next to the unit name and select your PTA position. Only the treasurer or the president may submit a sales tax refund request.

Council or Region Treasurer Instructions

Verify that each Local PTA has correctly filled out the Sales Tax Refund Request Form.

- Click on the User icon in the top right corner and click My Account.

- Click on the green $Tax button next to the name of your council or region. If the name does not appear in your PTA Units list, click the Add Unit button to link your council or region.

- The level column shows which level needs to review it next. The names of the unit requests will be red if they need to be advanced from your level and will be blue if they are already advanced or if you are waiting for the level below you to advance it. A region leader can advance any request from a unit in their region even if the council hasn't advanced it yet.

- Click the name of each unit to view their sales tax refund request. Review the list of transactions to make sure only eligible transactions have been submitted and that hand written numbers add up correctly.

- If there are any disallowed transactions, make an adjustment by noting the check or line number, amount of transaction, and the reason for the adjustment.

- Once the request has been reviewed, click the blue Advance button at the bottom of the form. The request is now ready to be processed by the next level. Click the checkbox on the next page certifying that you have checked the request for accuracy.

- Please make sure that the status is Pending for the level above you for each unit in your council or region.

- A region with councils can click into a unit and advance any returns to state if there isn't a council treasurer able to advance requests.

- If you receive a paper form from a local PTA and need to submit it, go to your My Account page. Click on the name of your council or region. If you are a region, locate and click on the council name in the council list. Locate and click on the local PTA name in the list of schools. Select the Sales Tax tab at the top right under the PTA name. Click the green +Submit Request button and follow the instructions on the form and complete all the fields, then click Save.

Please follow up with any units in your council or region that have not submitted a sales tax refund request.